BTC got to over $19,000 last week before crashing down to it’s current $12k-$13K levels, and at that time I figured I might take out my initial investment so I could feel comfortable that in this wild ride of crypto investing I wasn’t actually going to LOSE any money.

This is actually the firs time I had converted money out of an alt-coin or BTC to USD, so I was actually surprised at how difficult it is. Some learnings:

- This was a totally novice assumption, but you can’t trade BTC or alt-coins directly to USD on Exchanges like Bittrex or Poloniex. You have to take the coins off of the exchange to some place that does currency trading, like Coinbase or LocalBitcoins in the US, or Bitstamp in the UK.

- So I decided I wanted to take some of my gains in an alt-coin (Civic) and cash that out. This meant I needed to do a trade on Poloniex, then transfer that Bitcoin to Coinbase. I chose Coinbase because they have the most user-friendly interface, they have an app, and they guarantee your Bitcoins you hold in the Coinbase wallet. They definitely are NOT the cheapest – no wonder Coinbase is making a fortune.

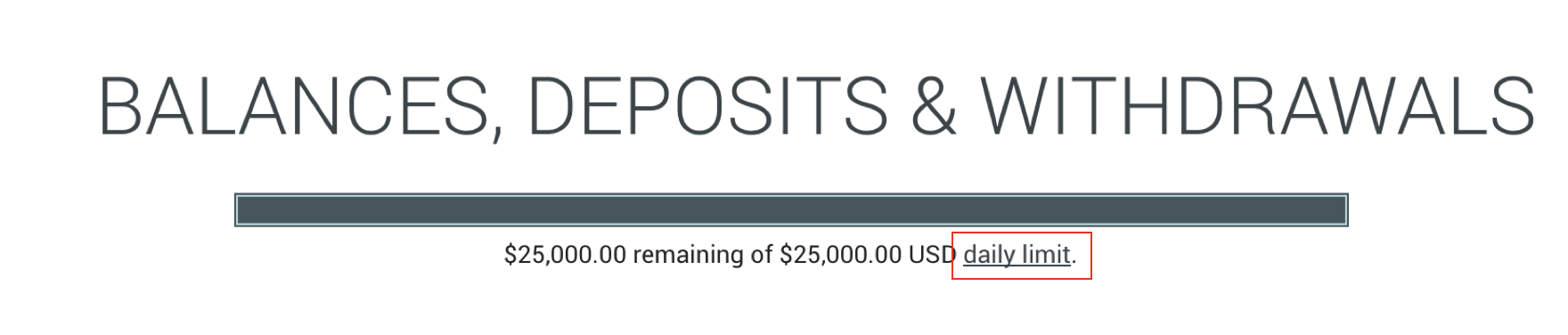

- Next step was to transfer the BTC out of Poloniex. All the Exchanges have a cap equivalent $USD you can transfer out per day, but they vary wildly. For Poloniex it is $25,000 (unless you are whale, in which I think you can get an overage). Bittrex is 100 BTC (so the equivalent of about $1.5M), Binance is the same, 100 BTC.

So I was limited by the amount that I could transfer out of Poloniex. If I had wanted to liquidate $50,000 in one day because I wanted to capitalize on the price of BTC to USD, I would have been out of luck. This is the rub – if you want to get everything out at once from an exchange you really can’t – NOTE TO SELF #1. Be religious of transferring stuff back and forth daily to your hard wallet. Holding coins on an Exchange is risky if they get hacked and also doesn’t allow you the flexibility of selling quickly for USD. Just keep there what you want to trade.

So I was limited by the amount that I could transfer out of Poloniex. If I had wanted to liquidate $50,000 in one day because I wanted to capitalize on the price of BTC to USD, I would have been out of luck. This is the rub – if you want to get everything out at once from an exchange you really can’t – NOTE TO SELF #1. Be religious of transferring stuff back and forth daily to your hard wallet. Holding coins on an Exchange is risky if they get hacked and also doesn’t allow you the flexibility of selling quickly for USD. Just keep there what you want to trade. - So I set up my Coinbase account to be able to convert out of BTC to USD. I transferred some BTC to the Coinbase wallet (which took over an hour – BTC is getting increasingly congested, more on that here).

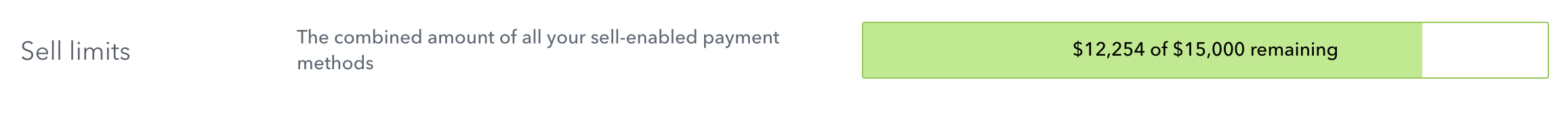

- Coinbase has a great interface and makes it super easy to sell BTC (and other coins) for USD, but they also have their own very strict sales guidelines. You can’t sell more than $10,000k equivalent BTC to USD in a week (the level can be increased to $15K with identity verification). Regardless if it was $10K or $15K, this level is super low and basically Coinbase has a stranglehold over most people easily cashing out BTC to USD. NOTE TO SELF #2. Don’t anticipate it will be easy to convert large amounts of BTC to USD quickly.

- Since I wanted to sell a bit more than $15,000 at this high BTC value, I figured I would try another recommended Crypto Currency trading exchange like Coinbase, called Bitstamp. Bitstamp came recommended to me as a well-regarded international player, so I transferred some BTC to Bitstamp and then sold it, which was as easy as Coinbase (they also have an app). It was only after doing this that I realized to get my USD to my US bank I would have to do an international wire transfer, which would take 7 days. Not ideal, so I just converted money back to BTC and sent to Coinbase (wasted about $30 in fees for that). NOTE TO SELF #3, Be aware of how long it is going to take for Coinbase or BitStamp to transfer your USD to your bank.

So, in the end I ended up selling $15K in BTC on Coinbase at the rate I wanted to, and then another amount at a lower rate the following week (because of Coinbase limits). If I had actually really wanted to liquidate a lot of BTC, this would have sucked given the value of BTC has dropped 30-40% in that week. It also took me 4 business days for the USD to hit my account.

I assume if there is a huge pop to the bubble, everyone will want to get their money out and the whole system is going to falter. The only way to avoid this is to have independent one-to-one connections with people who want to trade large amounts of BTC for USD (then there won’t be a third party establishing withdrawal or sales limits). I think this is what the real movers in the market do.

This made me realize the flaws in this for recreational speculators like me. There is no doubt if there is a massive popping of the bubble, everyone will be trying to yank their money off the exchanges at the same time (they have limits and also have struggled with infrastructure in times of high trade). The places where you can trade back to USD like Coinbase have low levels for money withdrawal, and if there is a run on the “bank”, Coinbase will have a lot of angry customers. Everyone will be desperately trying to get their money of Exchanges into places like Coinbase where they can sell for USD, all the while the price of BTC is plummeting. What a disaster.

But I believe in this for the long run and at least I got my original money out 😄

Mannabase a new Cryptocurrency is actually giving away FREE coins every week to new users. The best part is they are a Humanitarian organisation set to be bigger than Bitcoin. This could be the Biggest Free Investment you ever make. If you have 5 Minutes spare read the Whitepaper these Guys are something else. http://bit.ly/-FreeCryptocurrency

web site indexletme işlemi.